(NEXSTAR) – After months of negotiation during some of the darkest days of the pandemic, Americans are finally receiving their $1400 stimulus checks. Now, the question for many is, “What should I do with my COVID relief money?

Stimulus check money has been credited with bringing a flood of retail dollars into the stock market as people seek new income and perhaps a distraction from the pandemic. Before pouring stimulus dollars into the stock market, however, experts say there are important steps that must be taken first.

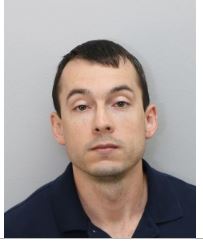

Warren Buffett

Legendary investor Warren Buffett says the first thing people should do when they receive a windfall of cash is to pay off credit card debts, according to MoneyWise.

Buffett, who has longed warned against credit card debt, explained his stance during the annual Berkshire Hathaway shareholders meeting last year with the case of a friend who recently received a sizable amount of money. That friend had credit card debt with 18% interest, he said.

“If I owed any money at 18%, the first thing I’d do with any money I had would be to pay it off,” Buffett recalled telling his friend. “You can’t go through life borrowing money at those rates and be better off.”

Buffett said he understands that the pandemic has forced many to use their credit cards out of necessity, but warned against using it as “a piggy bank to be raided.”

If $1,400 doesn’t cover the credit card debt, there are multiple ways to consolidate the debt and bring down the interest rate.

Suze Orman

Bestselling author and host of the “Women & Money” podcast Suze Orman devoted an episode to preparing Americans for the $1,400 stimulus checks and dependent relief payments.

Orman, 69, had these suggestions for people wondering what to do first with their money:

- Take care of your basic needs – if the pandemic has depleted your pantry and refrigerator, “take a lump sum of this money and buy as much canned food as you possibly can … at least you can have food to feed your kids.”

- Use the money to build a 12-month emergency fund.

- Prioritize your bills – make sure you have health insurance, pay your cellphone bill, pay your home bills. Orman dislikes credit card debt, but for people who may be out of a job, for instance, making minimum monthly payments to be able to save as much as possible is vital.

- Don’t immediately invest the money on the market, Orman says, because “that was not the goal of the stimulus check.”

- Put money in a Roth IRA account that will allow you to withdraw money tax-free, “if you want to be smart.”

Mark Cuban

“Shark Tank” investor and Dallas Mavericks owner Mark Cuban agreed with Orman, telling CNBC that the first step is to take care of essentials like food.

If there is money left over, that should go to paying down debt, according to Cuban.

“Pay off credit cards,” he said, adding that any remaining funds should go into the bank.

Credit card debt is crippling for many who carry a balance because of the compounding nature of the debt.

“If you owe money on your credit cards, the wisest thing you can do is pay off the balance in full as quickly as possible,” according to the U.S. Securities and Exchange Commission. “Virtually no investment will give you returns to match an 18% interest rate on your credit card.”