HAMPTON ROADS, Va. (WAVY) — As 10 On Your Side first reported in January, the Elizabeth River Crossings tunnels could be up for sale, and now we’re reporting the tunnels are now on the auction block.

Is a possible sale of any benefit to taxpayers or those using the tolls? We went to state Del. Steve Heretick, (D-Portsmouth), who is well aware of the possible sale after he says he was briefed last week by ERC CEO Doug Wilson. The bottom line: The old contract with Virginia is the contract for any new owner.

“Doug Wilson gave me a courtesy call to advise me the Elizabeth River Tunnels were formally on the sales block and it’s going on the market,” he said.

We have learned that sale is likely going to happen at an auction with the first round of the auction at the end of July. We also know the tunnel owner, Macquarie Group, has hired RBC Capital Markets to handle the sale.

“This is a contract with ready money and this is a fat contract … whomever buys the company certainly (operates) under the existing contract,” Heretick said.

However, that doesn’t mean Heretick won’t continue to appeal to a new owner to make the contract more equitable to taxpayers and the traveling public.

“We know this toll contract is the worst contract ever in the history of Virginia. Now at the point a new owner comes in, certainly it is possible for the commonwealth to go to them and say ‘Look can we renegotiate this deal?’” he said.

Whatever happens, Heretick says don’t expect any more money from state coffers. None.

“We have significant holes in the state budget. Now, as a result of the coronavirus pandemic we are being called back into session in mid-August to figure out what we need to do to make up those budgetary shortfalls,” he said.

We reached out to the Macquarie Group, and we got this from a Macquarie spokesperson:

“It is the policy of both Skanska and Macquarie not to comment on rumors or speculation. The companies are continuously evaluating strategic alternatives for mature projects where construction is complete and operations are stable.”

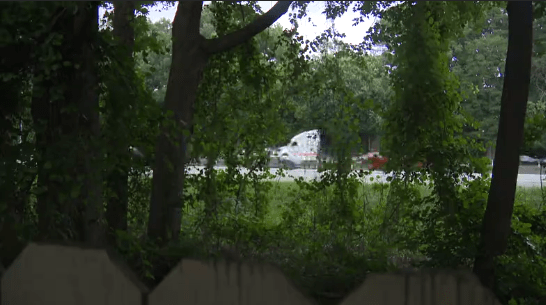

This possible sale is taking place at a terrible time for toll operators who have been slammed by COVID-19.

According to statistics in an S&P Global Ratings article, toll traffic globally is down 40 to 85 percent.

ERC wouldn’t give us numbers, but the industry report puts ERC’s first quarter revenue loss that includes the pandemic month of March down 14.45 percent compared to last year’s first quarter.

The second quarter report including April, May, and June could be the worst in recent history.