(NEXSTAR) – Do you feel like you make enough to cover your bills, buy the things you want, and set some money aside? A new analysis has found how much it takes to be able to afford to live in some U.S. cities.

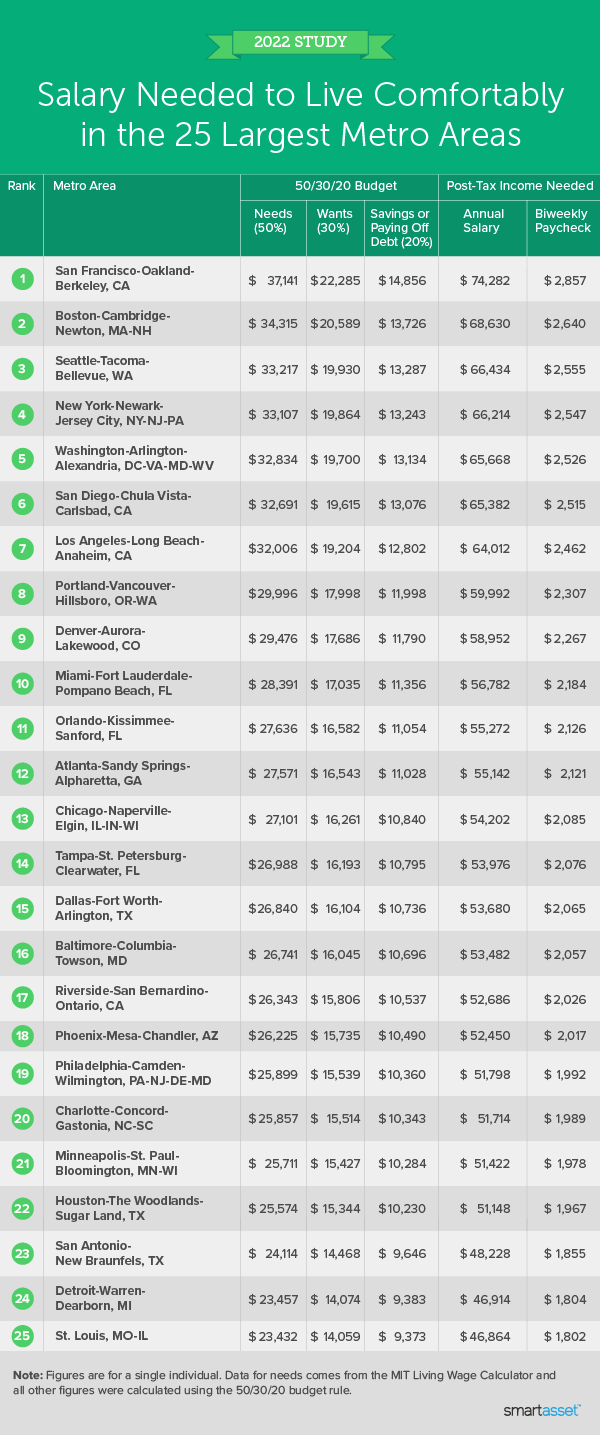

Using data from the MIT Living Wage Calculator and a common budgeting method, SmartAsset has calculated the salary a single person needs to earn to “live comfortably” in the 25 largest metro areas in the country.

The MIT Living Wage Calculator estimates the living wage needed to support individuals and families using “geographically specific expenditure data related to a family’s likely minimum food, childcare, health insurance, housing, transportation, and other basic necessities.” Living wages have been calculated for each state, the District of Columbia, and multiple counties and metro areas throughout the U.S.

Using the required annual income after taxes estimated by the living wage calculator, SmartAsset determined how much you need to make to “live comfortably” in the nation’s largest cities using the 50/30/20 rule.

A common budgeting technique, the 50/30/20 rule allocates your after-tax income to three categories: basic living expenses, discretionary spending, and saving or paying off debt.

SmartAsset used MIT’s estimated living wage salaries as the “needs,” or 50% of one’s budget. They then doubled that salary for their analysis, allowing for an individual to spend the rest on wants, saving, and paying off debt.

For example, the calculator says an individual living in the Houston metro area would need to earn $25,574 before taxes. Assuming that covers the basic living expenses, SmartAsset says an individual living in the Houston area would need to earn $51,148 to be comfortable following the 50/30/20 rule.

In its analysis, SmartAsset found cities along both the East and West coasts require the greatest post-tax income to live comfortably. Nine of the top 10 metros fall on one of the seaboards.

Topping out the list, unsurprisingly, was a California metro: San Francisco-Oakland-Berkley. SmartAsset found a single working person would need an annual post-tax salary of $74,282 to live comfortably in and around the City by the Bay.

Coming in second was Boston-Cambridge-Newton, where a single individual would need to make $68,630.

Ultimately, the most affordable metro area was St. Louis, where a salary of $46,864 is enough to satisfy the 50/30/20 rule. St. Louis edged out the Detroit-Warren-Dearborn area, where a salary of $46,914 is considered enough.

Cities throughout the South and Midwest also make an appearance on SmartAsset’s list. In 22 of the 25 cities on the list, a post-tax salary of more than $50,000 is considered adequate to live comfortably.

The average salary needed to live comfortably across all of the major metro areas is $57,013, according to SmartAsset.